As the property landscape in Sunderland continues to evolve, many homeowners who have been on the market for a while find themselves navigating the complex decision of when and how much to reduce their asking prices to attract buyers.

With an increasing number of properties on the market in the Sunderland area, rising from 1,086 in August 2022 to 1,382 in August 2024, the competition is becoming fiercer, making strategic price adjustments more crucial than ever.

(Sunderland – SR1 to SR6).

Mastering Property Portal Price Bands for Optimal Exposure

Understanding and utilising price bands on the portals (Rightmove, Zoopla and OnTheMarket) can significantly enhance the visibility of your property listing. These bands are predefined price ranges that buyers often use to filter their search results. Positioning your property’s asking price in one of these bands will strategically draw more views, and thus more interest, viewings and ultimately increase the chances of achieving a sale. For instance, pricing a property on a significant threshold, such as setting an asking price at £300,000 instead of £299,950, places the property in a search of £280,000 to £300,000 and £300,000 to £325,000, potentially attracting a broader audience.

The Importance of Rightmove Alerts

A critical factor in the timing of price reductions is their impact on buyer visibility. Homeowners need to reduce their asking price by at least 2% to ensure their property reappears in Rightmove’s email alerts, OnTheMarket it’s also 2%, while for Zoopla it is 3%, capturing the attention of active buyers.

Current State of Play in the Sunderland Property Market

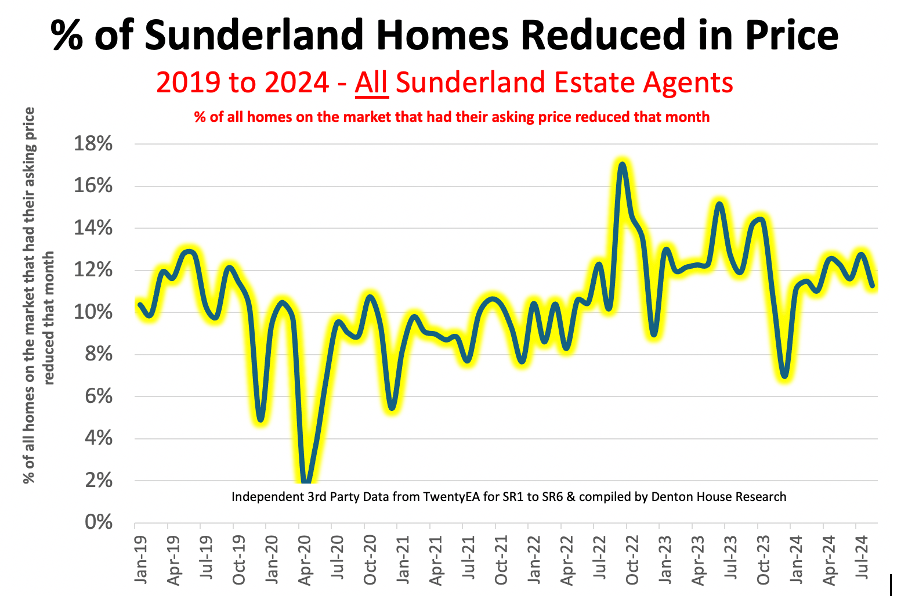

Several Sunderland home movers have said to me recently that they believe there are a greater number of price reductions happening at the moment, compared to a couple of years ago.

As I explained in the initial part of the article, the number of properties for sale has substantially grown in the last couple of years in the Sunderland area. If there are a greater number of properties for sale, I would expect a great number of price reductions.

In 2022, there were an average of 117 price reductions a month in the Sunderland area, today it’s 161 per month. The average Sunderland price reduction in the last 3 months was 5.9%.

So, the statistics for the Sunderland area reveal that while the number of properties for sale is on the rise, the number of reductions has increased. In fact, the percentage of Sunderland properties undergoing price reductions has remained roughly consistent in recent years, with an average of 1 in 9.6 Sunderland homes (10.4%) reducing their asking price each month over the last five and a half years.

This trend underscores the importance of setting a realistic price from the outset to stand out in a crowded market.

- An average of 10.7% of the 1,749 Sunderland properties on the market in 2019 reduced their asking prices per month.

- An average of 7.9% of the 1,502 Sunderland properties on the market in 2020 reduced their asking prices per month.

- An average of 9.1% of the 1,037 Sunderland properties on the market in 2021 reduced their asking prices per month.

- An average of 11.3% of the 1,027 Sunderland properties on the market in 2022 reduced their asking prices per month.

- An average of 12.3% of the 1,352 Sunderland properties on the market in 2023 reduced their asking prices per month.

An average of 11.8% of the 1,364 Sunderland properties on the market so far in 2024 have reduced their asking prices per month

The Ideal Pricing Strategy for Sunderland Homes

The initial pricing strategy plays a pivotal role in the speed and success of your property sale. Sunderland properties priced too high at the onset tend to linger on the market, eventually requiring more significant reductions to generate interest. In contrast, Sunderland homes priced realistically from the beginning are more likely to attract offers quickly, reducing the need for substantial price cuts.

For Sunderland homeowners considering a higher initial asking price, it’s advisable to be prepared to make an adjustment swiftly. A reduction within the first 2 to 4 weeks can prevent your property from stagnating on the market, whereas waiting 2 to 4 months might diminish your chances of securing a prompt sale.

Six Things to Consider for a Price Reduction

- A Lack of Viewings: If you haven’t received many viewings in the initial few weeks, then look at your photographs and details on the portals and compare them with other properties in your price range. If they are up to standard, then it may be time to reconsider pricing and time to talk to your agent in more detail to attract more viewings.

- Viewings But No Offers: The UK property market ‘viewings to offers ratio’ is between eight to ten viewings per offer. If your property hasn’t received any offers within the first 30 days, yet you have had lots of viewings, that could suggest the price is a sticking point. You could ask why they don’t make an offer, yet research has shown many people don’t want to make an offer that they perceive could offend i.e., a lot lower than the asking price. Therefore, it could be time to consider a reduction and bring your asking price closer to your bottom line.

- Low Offers: Homebuyers often make low offers for a variety of reasons, primarily to secure the best possible deal. One key factor is market conditions; in a buyer’s market, where there are more homes available than there are buyers, purchasers feel they have more negotiating power. Another reason is property condition – if a home requires repairs or renovations, buyers may offer less to compensate for the additional investment needed. Sometimes, buyers also make lower offers based on their own budget constraints, hoping to enter a negotiation where they can find a middle ground. Additionally, uncertainty about the future Sunderland property market may lead them to make more cautious, conservative offers. If you are getting low offers, it’s always smart to remember that a home is worth what someone’s willing to pay. Not what you think it’s worth. Not what the estate agent says it’s worth but what a buyer is prepared to pay.

- Market Saturation: Look at the number of Sunderland homes that are on the market like yours (e.g., if you have a 2-bed apartment, look at all the 2-bed apartments on the market and sold stc). Look objectively at your home, do you stand out from your competition? Those that are sold stc should have a greater influence on your decision than those on the market. Also, ask your friends to do the same. Ask them to be 100% honest with you. Adjusting your price to become more competitive could help.

- Seasonal Adjustments: Be mindful of the seasonal trends in the Sunderland property market. Periods of high market activity might require different strategies from the slower months of say November and December.

- Feedback from Viewings: Consistent feedback regarding the asking price of your Sunderland home during viewings is a clear indicator that adjustments are necessary.

Leveraging Expert Advice

Given the complexities of the Sunderland property market, seeking a second opinion from an expert such as ourselves can provide you with insights tailored to your specific situation. It’s essential to choose a consultant who will offer honest advice, possibly telling you what you need to hear rather than what you want to hear.

Are you currently on the market in Sunderland and contemplating a price reduction? Or perhaps you’re seeking to list your property soon? For a no-obligation consultation and a fresh perspective on your property strategy, feel free to contact me. Together, we can ensure that your home is positioned effectively to attract buyers and achieve a successful sale.